Our successful impact now and in the future is linked to your continued support. In addition, C4C has developed internal initiatives to deliver more capital to BIPOC borrowers and developers. the Thus the genesis and words of the Amendment unite in showing that it does not. Gillett, the PURA chair who dissented in the authority’s 2-1 vote to accept a 103 million settlement that Eversource negotiated with the Lamont. Many small businesses in CT were hit hard by COVID and C4C is eager to participate in delivering relief in conjunction with the state as C4C is doing with the Unite CT rental assistance program. The compromise bill offers a nod to Marissa P. C4C will be working with DECD and NDC in the CT Small Business Boost Fund to deliver committed funds into the hands of local businesses. With nearly 3,000 new loans added, these energy efficiency loans funded much-needed improvements and helped to reduce carbon emissions.Īlong with more growth in the areas already mentioned, C4C will be expanding its work in the coming year with added emphasis on small business and non-profit lending as well as intensifying our focus on racial equity impacts.

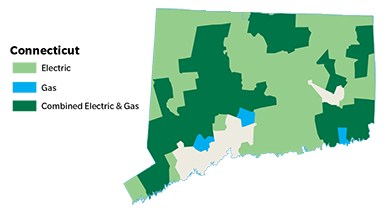

$3 million higher than the previous year. Through the first three months of the current fiscal year, C4C is already ahead of last year’s pace in terms of commercial lending as we look to add to the nearly $70 million in loans funded since our merger in 2016.Ĭonsumer energy efficiency financing programs delivered $28 million in new loans which was Eversource, which serves over 1. $500,000 CHFA tax credit grant funded by Eversource in support of affordable housing $2.4 million from the US Treasury in the form of two grants $28.8 million in pooled funding support (MPLP3) from 14 partnering banks, which is up dramatically from 2018’s prior pooled funding (MPLP2) of $20 million with 11 partnering banks Well over 60% of these loans were in low to moderate-income census tracts, and over 60% of the beneficiaries have been people of color.įunding from grants and our financial business partners are helping to set the stage for growth in the coming year. In commercial lending, this rebound was evident in the 25 new loans totaling over $9 million that were closed for affordable housing projects and non-profit lending. Rebounding from the impacts of COVID, Capital for Change (C4C) had a busy year channeling recovery funding and staff resources to support our mission. We are pleased to provide our 2022 Annual Report covering the Fiscal Year ending March 31, 2022.

0 kommentar(er)

0 kommentar(er)